QuickBooks Chart of Accounts List PDF: A Comprehensive Guide (Updated 12/22/2025)

Today, December 22, 2025, accessing and managing your QuickBooks financial data is streamlined with downloadable Chart of Accounts lists in PDF format.

These PDF lists, crucial for organization, are readily available for download, aiding in tasks like initial QuickBooks setup (February 26, 2025) and self-assessment integration (April 14, 2025).

QuickBooks’ Chart of Accounts serves as the foundational backbone for your company’s financial tracking system. It’s essentially a categorized list of all the accounts used to record financial transactions – income, expenses, assets, liabilities, and equity. Understanding this structure is paramount for accurate financial reporting and informed business decisions.

As of today, December 22, 2025, QuickBooks offers various plans, including QuickBooks Sole Trader (launched April 14, 2025), designed to simplify financial management for self-employed individuals. Regardless of the plan, the Chart of Accounts remains central.

The ability to download a Chart of Accounts list as a PDF (discussed further later) provides a convenient way to review, share, and even import account structures. Proper setup, especially during first-time QuickBooks login (February 26, 2025), is vital. This introduction sets the stage for a deeper dive into the components and benefits of a well-organized Chart of Accounts within QuickBooks.

What is a Chart of Accounts?

A Chart of Accounts (COA) is a comprehensive listing of all the accounts a business uses to define its financial transactions. Think of it as a financial blueprint, organizing income, expenses, assets, liabilities, and equity into specific categories. Within QuickBooks, this structure is crucial for accurate bookkeeping and generating meaningful financial reports.

Downloading a Chart of Accounts list as a PDF provides a static snapshot of this organization. This PDF format is particularly useful for sharing with accountants or for archival purposes. Whether utilizing QuickBooks Online, QuickBooks Ledger (for accountants – June 10, 2025), or QuickBooks Sole Trader (April 14, 2025), the COA remains fundamental.

The COA isn’t just a list; it’s a hierarchical structure. Proper categorization, especially during initial QuickBooks setup (February 26, 2025), ensures data accuracy and facilitates seamless integration with tools like TurboTax (March 9, 2020).

Why is a Chart of Accounts Important?

A well-structured Chart of Accounts is the backbone of sound financial management within QuickBooks. It’s vital for accurate financial reporting, enabling informed business decisions. Downloading a Chart of Accounts list as a PDF provides a clear overview for analysis and sharing with stakeholders.

For sole traders utilizing QuickBooks Sole Trader (November 7, 2024, and April 25, 2025), a correctly configured COA simplifies Self Assessment integration. Accountants supporting clients benefit from the clarity offered by QuickBooks Ledger (June 10, 2025) and the ability to review a PDF version of the COA.

Furthermore, a detailed COA facilitates efficient tax preparation, especially when integrating with TurboTax (March 9, 2020) or utilizing Accounts Production and Pro Tax (May 28, 2025). Accurate categorization, reflected in the PDF, ensures compliance and maximizes potential VAT refunds through InstantVAT integration (December 12, 2024).

Understanding QuickBooks Account Types

QuickBooks categorizes accounts into Asset, Liability, and Equity types, reflected in downloadable PDF lists. These classifications are fundamental for accurate financial tracking and reporting.

Asset Accounts

Asset accounts in QuickBooks, detailed within your Chart of Accounts PDF, represent what your company owns. These include current assets – readily convertible to cash within a year, like Cash on Hand, Accounts Receivable (money owed by customers), and Inventory.

Long-term assets, also listed in the PDF, are those with a lifespan exceeding one year, such as Buildings, Equipment, and Vehicles. Properly categorizing these assets is vital for accurate balance sheet reporting. The Chart of Accounts ensures consistent tracking of asset values, aiding in financial analysis and tax preparation.

Understanding these distinctions, as presented in the downloadable PDF, is crucial for effective financial management within QuickBooks, especially when integrating with tools like TurboTax (March 9, 2020) or preparing for Self Assessment (April 14, 2025).

Liability Accounts

Liability accounts, clearly outlined in your QuickBooks Chart of Accounts PDF, represent what your company owes to others. These are categorized as current liabilities – debts due within a year – such as Accounts Payable (money owed to suppliers), Salaries Payable, and short-term Loans Payable.

Long-term liabilities, also detailed in the PDF, extend beyond one year, including Mortgages Payable, long-term Loans, and Deferred Revenue. Accurate tracking of liabilities is essential for maintaining a healthy financial position and fulfilling obligations. The Chart of Accounts provides a structured system for monitoring these debts.

Proper categorization, as found within the downloadable PDF, is vital for accurate financial reporting and integration with services like Accounts Production and Pro Tax (May 28, 2025), ensuring compliance and informed decision-making.

Equity Accounts

Equity accounts, detailed within your QuickBooks Chart of Accounts PDF, represent the owner’s stake in the company. For sole proprietorships and partnerships, this typically includes Owner’s Equity or Partner’s Capital. Corporations utilize accounts like Common Stock and Retained Earnings, reflecting investments and accumulated profits.

The PDF list facilitates tracking contributions from owners, distributions of profits, and the overall financial health of the business. Accurate equity accounting is crucial for determining net worth and assessing the company’s financial stability.

Understanding these accounts, as presented in the downloadable Chart of Accounts, is particularly important for sole traders integrating QuickBooks with Self Assessment (April 14, 2025). Proper categorization ensures accurate reporting and compliance, supporting informed financial management and tax preparation.

Income and Expense Accounts in QuickBooks

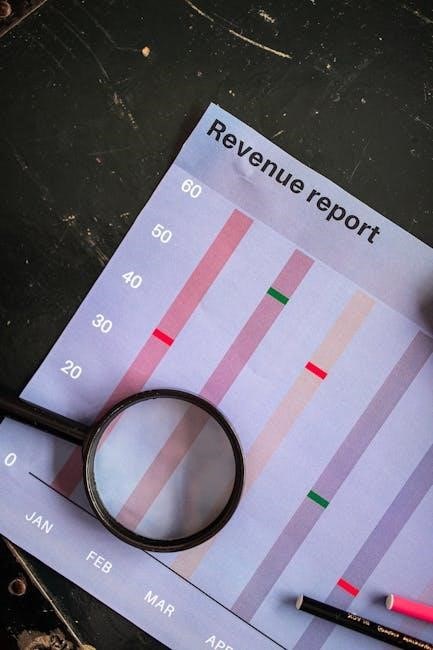

QuickBooks’ Chart of Accounts PDF meticulously categorizes income (revenue) and expenses, vital for profitability analysis and accurate financial reporting, as of December 22, 2025.

Income Accounts (Revenue)

Income Accounts within your QuickBooks Chart of Accounts PDF represent all money flowing into your business. These are categorized to reflect revenue streams, providing a clear picture of your earnings. Common examples include Sales of Products, Service Income, and potentially Interest Income.

A well-structured Chart of Accounts, downloadable as a PDF, allows for detailed tracking. For sole traders utilizing QuickBooks Sole Trader (launched April 14, 2025), accurate income categorization is crucial for Self Assessment integration.

The PDF list facilitates easy review and ensures all income sources are accounted for. Furthermore, understanding these accounts is essential when integrating with tools like TurboTax (March 9, 2020), ensuring seamless tax preparation. Properly classifying income within QuickBooks, as reflected in the PDF, is fundamental to sound financial management as of December 22, 2025.

Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) accounts, detailed within your QuickBooks Chart of Accounts PDF, track the direct costs associated with producing goods sold by your business. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS tracking is vital for calculating gross profit and overall profitability.

Reviewing your COGS accounts in the PDF list ensures all relevant expenses are captured. For businesses utilizing QuickBooks, especially those integrating with Accounts Production and Pro Tax (May 28, 2025), precise COGS categorization is paramount.

The PDF provides a clear overview, aiding in financial analysis and tax reporting. Understanding these costs, as outlined in the downloadable Chart of Accounts, is crucial for informed decision-making as of December 22, 2025, and supports accurate financial statements.

Expense Accounts

Expense Accounts, comprehensively listed in your QuickBooks Chart of Accounts PDF, categorize all costs incurred in running your business, excluding the direct costs of goods sold. These encompass operating expenses like rent, utilities, salaries, marketing, and administrative costs.

A well-defined Expense Accounts section within the PDF facilitates accurate financial reporting and tax preparation. Utilizing QuickBooks, particularly with integrations like TurboTax (March 9, 2020), relies on correctly classified expenses. The PDF serves as a vital reference for consistent categorization.

Reviewing this section of the Chart of Accounts, as of December 22, 2025, ensures all business expenditures are properly tracked. For QuickBooks Sole Trader users (April 25, 2025), detailed expense tracking is essential for Self Assessment compliance and maximizing allowable deductions.

QuickBooks Sole Trader Chart of Accounts

QuickBooks Sole Trader, launched April 14, 2025, offers a tailored Chart of Accounts, simplifying self-assessment for individuals earning under £90,000 (November 7, 2024).

Specific Accounts for Sole Traders

QuickBooks Sole Trader, designed for self-employed individuals and landlords, features a pre-populated Chart of Accounts optimized for their unique needs (April 14, 2025). This includes dedicated accounts for drawings, personal expenses, and sole trader income, streamlining financial tracking.

Unlike standard QuickBooks plans, the Sole Trader version automatically categorizes income and expenses relevant to self-employment, reducing manual input and potential errors. Key accounts often include ‘Sales Income’, ‘Cost of Sales’, ‘Advertising & Marketing’, ‘Vehicle Expenses’, and ‘Home Office Expenses’.

Accountants supporting Sole Trader clients benefit from enhanced features introduced on April 25, 2025, allowing for more efficient client management. The Chart of Accounts can be customized, but the default setup provides a solid foundation for accurate financial reporting and simplified Self Assessment tax returns.

Integrating QuickBooks Sole Trader with Self Assessment

QuickBooks Sole Trader is specifically designed to simplify the Self Assessment tax return process for self-employed individuals and landlords (April 14, 2025). The software’s Chart of Accounts is structured to align with HMRC requirements, making data transfer seamless.

Key to this integration is the accurate categorization of income and expenses within the Chart of Accounts. QuickBooks automatically calculates taxable profit, reducing the risk of errors and ensuring compliance. Accountants can leverage this integration to efficiently prepare and submit client tax returns.

The system facilitates direct submission of data to HMRC, minimizing manual data entry. Utilizing the correct Chart of Accounts setup, particularly with accounts for allowable expenses, maximizes potential tax savings. This integration represents a significant time-saving benefit for both sole traders and their accounting professionals.

QuickBooks Online & Accountant Versions

QuickBooks Online offers customizable Chart of Accounts (March 5, 2025), while QuickBooks Ledger, for accountants (June 10, 2025), provides advanced client management features and PDF access;

QuickBooks Online Chart of Accounts Customization

QuickBooks Online empowers users with extensive Chart of Accounts customization options, allowing for tailored financial tracking. This flexibility is crucial for accurately representing a business’s unique financial structure. Users can add, edit, or delete accounts as needed, ensuring the Chart of Accounts aligns with specific industry requirements and reporting needs (March 5, 2025).

Downloading a Chart of Accounts list as a PDF facilitates easy sharing with accountants or for archival purposes. Customization extends to account types – asset, liability, equity, income, and expense – enabling detailed categorization of transactions. This detailed categorization is vital for generating insightful financial reports. The ability to import data from other tools, like TurboTax (March 9, 2020), further enhances the customization process, streamlining data migration and ensuring accuracy.

Furthermore, the integration with Accounts Production and Pro Tax (May 28, 2025) demonstrates how a well-customized Chart of Accounts directly supports efficient tax preparation and compliance.

QuickBooks Ledger (Accountant Users Only)

QuickBooks Ledger, exclusively for accounting professionals, offers a specialized environment for managing client Charts of Accounts. Unlike standard QuickBooks Online plans, Ledger isn’t directly sold to businesses (June 10, 2025), but rather provides accountants with a robust platform to service multiple clients efficiently.

Accountants can leverage QuickBooks Ledger to create and maintain detailed Charts of Accounts tailored to each client’s specific needs. Downloading a client’s Chart of Accounts as a PDF simplifies collaboration and provides a clear record of account structures. This is particularly useful when onboarding new clients or conducting financial reviews.

The platform’s advanced features support complex accounting tasks and ensure compliance. Integration with other tools, alongside the ability to customize and export Chart of Accounts data, makes QuickBooks Ledger an invaluable asset for accounting practices.

Importing & Integration with Other Tools

QuickBooks seamlessly integrates with tools like TurboTax (March 9, 2020) and Accounts Production/Pro Tax (April 25, 2025), simplifying tax preparation and financial reporting using PDF lists.

Importing from QuickBooks Online to TurboTax

QuickBooks Online offers a streamlined import process directly to TurboTax, significantly simplifying your tax filing experience (March 9, 2020). This integration allows for a seamless transfer of your financial data, including details from your Chart of Accounts, minimizing manual entry and reducing the risk of errors.

When importing, QuickBooks categorizes your income and expense accounts, mapping them appropriately within TurboTax. This ensures accurate reporting and helps you maximize potential deductions. The Chart of Accounts data, often exported as a PDF for record-keeping, provides a clear overview of your financial transactions during the tax year.

Before importing, it’s recommended to review your Chart of Accounts within QuickBooks to ensure all accounts are correctly categorized. This proactive step guarantees a smoother transition and more accurate tax return. Utilizing this integration saves valuable time and effort, especially for small business owners.

Accounts Production & Pro Tax Integration

QuickBooks Online boasts powerful integration capabilities with Accounts Production and Pro Tax, streamlining financial reporting and tax preparation (May 28, 2025). These features are particularly beneficial for businesses requiring detailed statutory accounts and complex tax filings.

The integration leverages your QuickBooks Chart of Accounts, ensuring data consistency across platforms. Your categorized income, expenses, assets, and liabilities are seamlessly transferred, reducing manual input and potential discrepancies. A PDF export of your Chart of Accounts serves as a valuable audit trail and reference document.

Accounts Production facilitates the creation of compliant financial statements, while Pro Tax assists with accurate tax calculations and submissions. This integration minimizes errors and ensures adherence to regulatory requirements. Utilizing these tools, alongside a well-maintained Chart of Accounts, significantly simplifies year-end processes.

Advanced Features & Updates

QuickBooks’ AI platform (March 5, 2025) enhances Chart of Accounts management, while InstantVAT integration (December 12, 2024) expedites PDF-based VAT refund processing.

QuickBooks AI Platform & Chart of Accounts

QuickBooks’ integration of an artificial intelligence (AI) platform, announced at the annual Get Connected conference on March 5, 2025, is revolutionizing how users interact with their Chart of Accounts. This AI isn’t about replacing accountants; it’s about augmenting their capabilities and providing deeper insights.

The AI can intelligently categorize transactions, suggesting appropriate accounts within the Chart of Accounts, minimizing errors and saving valuable time. It learns from past classifications, becoming more accurate over time. This is particularly useful when importing data or generating PDF reports.

Furthermore, the AI can identify anomalies and potential discrepancies within the Chart of Accounts, flagging them for review. This proactive approach helps maintain data integrity and ensures accurate financial reporting. The AI also assists in optimizing the Chart of Accounts structure itself, suggesting improvements for clarity and efficiency, ultimately streamlining PDF export processes.

InstantVAT Integration & VAT Refunds

QuickBooks’ integration with InstantVAT, established on December 12, 2024, dramatically accelerates VAT refund processing for businesses. Traditionally, HMRC processing could take up to ten days; InstantVAT reduces this to as little as 24 hours, significantly improving cash flow.

This integration directly impacts the accuracy and efficiency of your Chart of Accounts. Properly categorized VAT transactions within QuickBooks are essential for InstantVAT to function optimally. A well-structured Chart of Accounts ensures seamless data transfer and accurate refund calculations.

When generating a Chart of Accounts list PDF for VAT reporting, it’s crucial to verify that all VAT-related accounts are correctly mapped. InstantVAT relies on this accurate categorization to expedite refunds. Regularly reviewing and updating your Chart of Accounts, especially VAT accounts, is vital for maximizing the benefits of this integration and ensuring accurate PDF reports.

Accessing & Managing Your Chart of Accounts

QuickBooks simplifies Chart of Accounts access through the dashboard (February 26, 2025), offering PDF downloads for easy management and reporting purposes.

Downloading a Chart of Accounts List as a PDF

QuickBooks provides a convenient method for exporting your Chart of Accounts as a PDF document, facilitating offline access and simplified sharing with accountants or bookkeepers. This feature, essential for organization and reporting (December 22, 2025), allows users to easily download a comprehensive list of all accounts.

To download, navigate to the QuickBooks dashboard and locate the Chart of Accounts section. From there, an export option, typically offering PDF as a format, will be available. This PDF version maintains the account structure and details, making it ideal for record-keeping and analysis. It’s particularly useful during initial QuickBooks setup (February 26, 2025) or when integrating with tax preparation software like TurboTax (March 9, 2020).

The PDF format ensures compatibility across various devices and platforms, simplifying collaboration and data management. Regularly downloading a PDF backup of your Chart of Accounts is a best practice for data security and disaster recovery.

Navigating the QuickBooks Dashboard for Account Management

The QuickBooks dashboard serves as the central hub for managing your Chart of Accounts and overall financial data. Upon logging in (February 26, 2025), users can readily access the Chart of Accounts section, typically found within the “Lists” or “Accounting” menu; This area provides a clear overview of all accounts, categorized by type – assets, liabilities, equity, income, and expenses.

From the dashboard, you can add new accounts, edit existing ones, and reorder them to suit your reporting needs. The intuitive interface allows for easy navigation and efficient account management. This is particularly helpful during the initial QuickBooks setup process, personalizing your experience (February 26, 2025).

Furthermore, the dashboard integrates seamlessly with other QuickBooks features, such as reporting and invoicing, ensuring a cohesive financial management experience. Regularly reviewing and updating your Chart of Accounts via the dashboard is crucial for accurate financial reporting and informed decision-making.

First-Time QuickBooks Setup & Chart of Accounts

Setting up QuickBooks for the first time requires careful attention to your Chart of Accounts. During the initial login process (February 26, 2025), you’ll be prompted to define your business type and industry, personalizing your experience. QuickBooks often provides a default Chart of Accounts based on your industry, offering a solid starting point.

However, it’s crucial to review and customize this default list to accurately reflect your specific business operations. Consider adding accounts tailored to your unique income streams, expenses, and assets. Downloading a Chart of Accounts list as a PDF can be helpful for planning and organization before inputting data.

A well-defined Chart of Accounts from the outset ensures accurate financial tracking and reporting. Taking the time to establish a robust system during setup will save you significant effort and potential errors down the line, especially when integrating with tools like TurboTax (March 9, 2020).